How To Announce Your Funding

So it’s a big funding event – Here’s how to announce it

anthonyBarnum has been working with venture capital and private equity funded innovation companies for more than a decade. As a result, we’ve led efforts to announce countless funding events—from seed rounds up to mega PE buy-outs, and everything in between. There are methods and strategies to maximize the outcomes of releases that make a difference in the final outcomes, and key facets to keep in mind.

Here are our top recommendations for approaching the funding announcement:

1) Timing

Form D filings can wreck a PR strategy. In the event of a funding, the PR strategy must be in sync if a Form D filing will be made. Many reporters who cover fundings track these filings and will develop stories from these alerts, thus developing their own narrative based on what they can collect from the company’s and financial firm’s sites. To sculpt the narrative, it’s critical to know when this filing is happening to ensure the release goes out in advance.

2) Define the Objective

Not every marketing executive and CEO will have the exact same objective for their press release. The vision for what is seeking to be accomplished can vary widely. Here are some common scenarios:

- The company wants as much coverage as possible in their market to raise awareness and demonstrate they are a next-level contender in their category.

- The company is most interested in receiving Tier 1 national deal coverage because they are seeking to be positioned as the market leader in their category.

- The marketing team and CEO would prefer to have less coverage because their concern is that the funding makes the company look too new and less credible than their competitors.

- The funding announcement is a distraction from key messages the company wants to convey to its market and executives wish to minimize and even hide the announcement altogether.

Companies tend to be nearly evenly split across these four objectives.

3) Getting Coverage

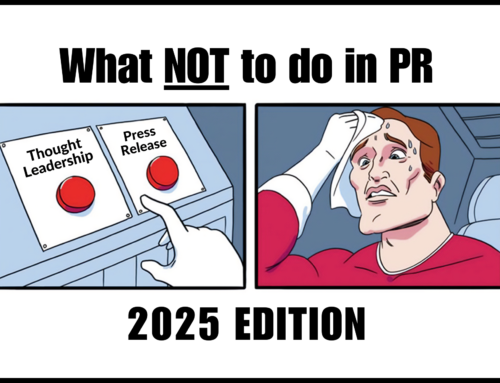

If the objective is to maximize visibility to a persona target audience or garner Tier 1 national media, our top recommendation is to start the PR campaign in advance of the deal closing to familiarize target media with the company. Innovation companies who have been introduced to their target media, based on our extensive number of case studies and analysis of outcomes, will garner more coverage if they have a thought leader-oriented earned media campaign preceding the funding event by 3 months.

4) Be Rational

Unicorns and fundings over $75M with a directed, intentional PR campaign will garner Tier 1 national business and tech coverage. However, depending on how interesting the technology is, interest in coverage can vary significantly for companies $50M to $5M among the Tier 1s. A really fascinating drone, AI or robotic technology can receive a lower level of funding and generate more results than a more obscure type of platform receiving larger dollars.

It’s important to finesse out the hook of the technology and its implications on the market. If it’s a $20M funding in a rather obscure market, consider working in advance of the announcement to establish a presence in target media in order to maximize coverage.

5) Tell Us Skeletons

A wise PR firm is going to research their client and their history leveraging their advanced Share of Voice and media tools—but not for all of time and not for every executive on the team. If there is any baggage, the PR team needs to be aware to create a strategy to tackle it head on and evaluate how best to position the release in light of it. We can help assess what assets need to be in place to manage any possible issues that come up. Offer up any and all concerns so they can be integrated into the approach starting on day-one.

Funding announcements are exciting and high-stakes. Defining the real objectives, conducting research, and preparation help to make the most of the opportunity.